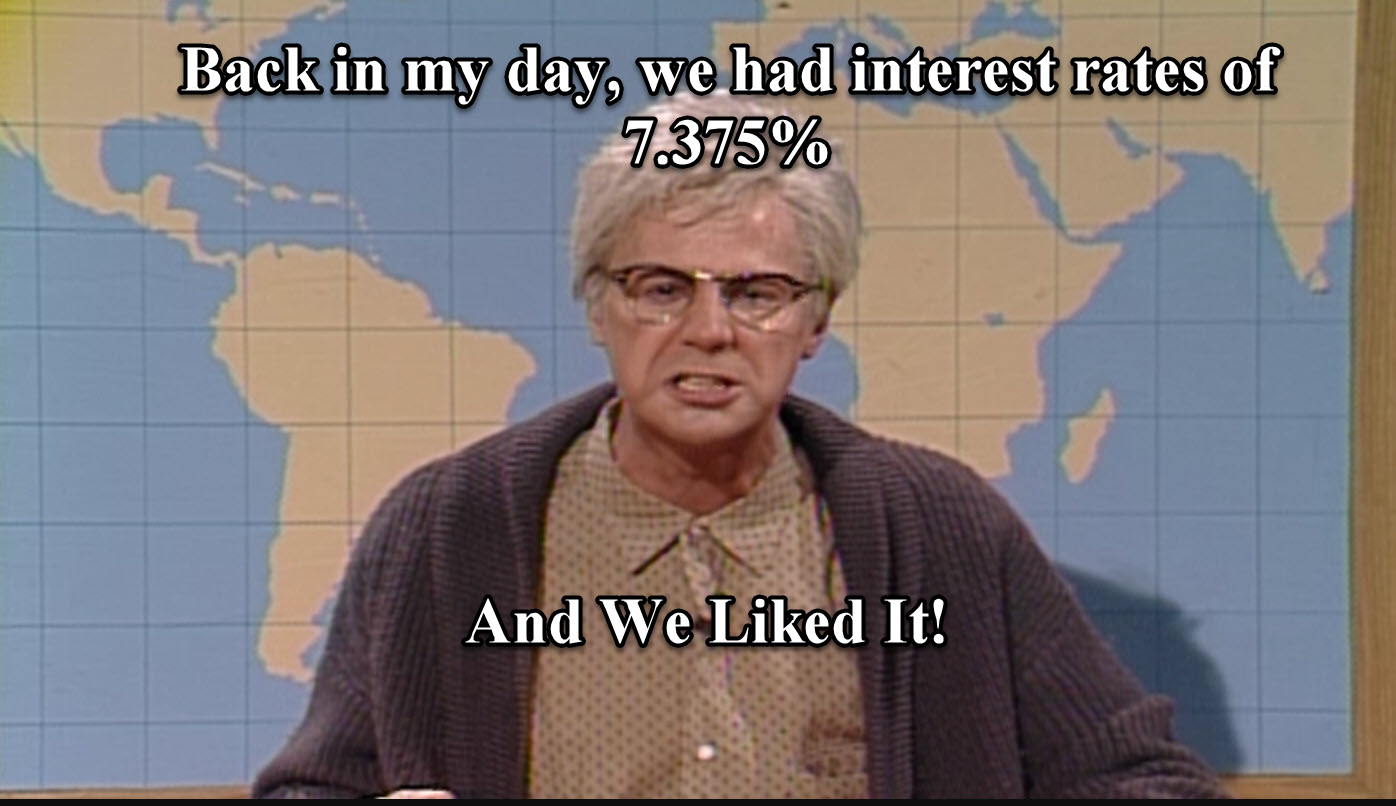

As I get older (I’m 45), the TV character I most identify with is the old man on SNL Weekend update from the 90’s played by Dana Carvey. He was an embittered archetypical grandfather figure with white hair, glasses, and a sour sneer. He would complain about the state of the world, mainly in regard to many modern conveniences. His complaints always included differences between today and “his day”, always ending with his catchphrase, “and I liked it!” Today as I see so much discussion about rates, I find myself telling people, “back when I bought my first primary home and investment home, my rate was 7.375%, and I liked it!” Or, “My cash flow on my fist investment property was $165 a month and I liked it!” All that said, I totally get the rate concern. We have been spoiled by very low rates for a long time. I wouldn’t be honest if I were looking at some current deals I am working to build my portfolio with rates around 6%, thinking to myself how much nicer it was 4 months ago to capture a 4.5% rate, but it is what it is. I am not going to put my financial goals on hold and stop building my real estate portfolio because of higher rates. When you are building a real estate portfolio, you take what the market gives you and keep moving forward. Right now, I am putting down more $ up front to make the deals fit my investment strategy.

Below is a mortgage statement from my first rental property I bought in 2007 and still own today. The rate was and still is 7.375%. The mortgage amount was much lower, but so was the rent of $750. My gross monthly cash flow in year 1 was $165 a month and that first tenant I had to evict. 15 years later, the rent on that home is $1,195. The value of the property has doubled, but while that is nice, since I have no plans to sell, the valuation is not a huge concern of mine. My focus is on the cash flow.

Rates over the past week have lowered to the 6% to 6.35% range for investment property with 20% down. Rates with a 25 to 30% down, could be as low as 5.25%, which is just .75% higher than a few months ago.

Schedule a Consult

Schedule a Consult