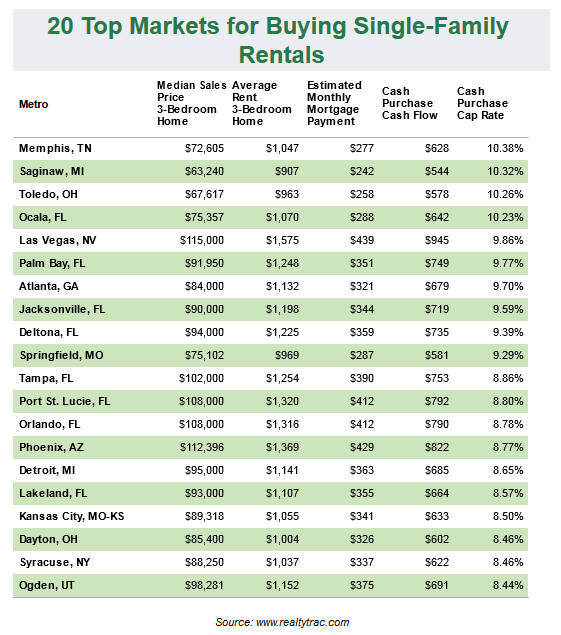

A recent Wall Street Journal article ranked the Top 20 cities in the United States for Buying Investment Property- specifically, single-family houses. The ranking was based on a study by the Foreclosure-tracking firm RealtyTrac, which ranked the 20 best markets in the country for landlords to buy single-family rental houses by calculating the annual return an investor could achieve from buying and renting out a typical three-bedroom house.

Memphis ranked #1 with a Median Sales Price of $72,605 and an average rent of $1,047 on a 3 bedroom house.

It’s no secret that recently Major Wall Street investment firms have poured billions of dollars into distressed real estate markets- buying hundreds of single-family rentals for major Hedge Funds. The strategy has worked so far—big landlords like Blackstone Group LP BX +3.59% and Colony Capital LLC have said they expect initial yields of 5% to 8% on their single-family home portfolios, which number in the thousands of homes—but some observers say it may be hard to sustain those profits for long.

Memphis ranks #1 for Investment Returns with Cap Rates on Single Family Rentals consistently exceeding 10% per year. Despite having the reputation of being a “second tier” city, Memphis has a solid base of renters that have kept returns steady for the past 4-5 years now. And with new jobs coming into the city over the next 2-3 years (i.e Electrolux, Bass Pro Shop, etc.) it doesn’t look as if that will change anytime soon.

Property Management is a CRITICAL COMPONENT to the success of any real estate rental portfolio. This is where Memphis Turnkey Properties and her sister company- CB Property Management continue to excel above the competition. We continue to applaud Benolyn Craig and her team for the EXCEPTIONAL JOB they have done in managing our clients’ portfolios and continuing to produce a quality investment product!

Source– April 5, 2013, on page A3 in the U.S. edition of The Wall Street Journal, with the headline: Rental Investors Find Rich Pickings in Midwest, SouthTop Cities for Single-Family Home Investors.

CONTACT US for more information.

Schedule a Consult

Schedule a Consult